What is gap insurance? It’s a crucial financial tool that can protect you from significant financial losses if your vehicle is totaled or stolen. Read on to understand how gap insurance works, its benefits, and whether it’s right for you.

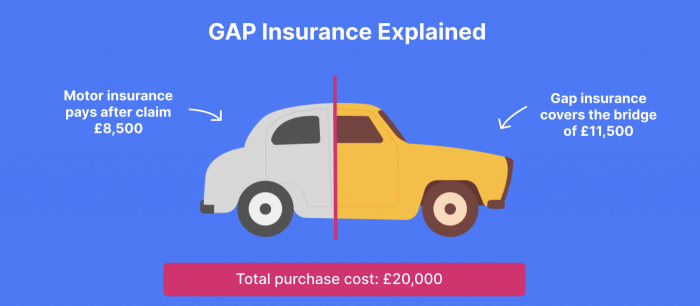

Gap insurance covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan. This can be especially beneficial if your vehicle is newer or if you have a high loan-to-value ratio.

Overview of Gap Insurance

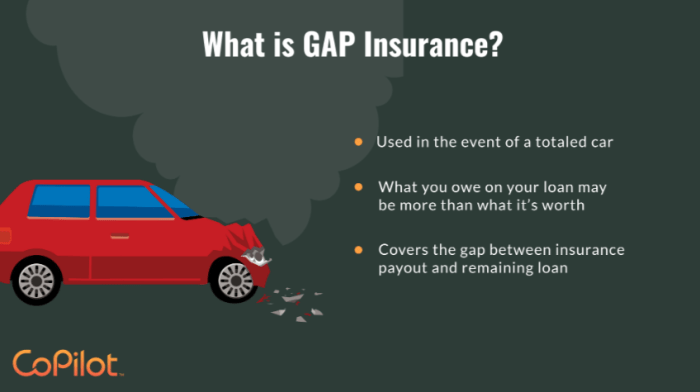

Gap insurance is an optional auto insurance policy that helps cover the difference between the actual cash value of your car and the amount you still owe on your loan or lease. It’s designed to protect you from being “underwater” on your car loan if your vehicle is totaled or stolen.

There are two main types of gap insurance: loan/lease gap and replacement gap. Loan/lease gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your loan or lease. Replacement gap insurance covers the difference between the actual cash value of your car and the cost of replacing it with a new or comparable vehicle.

Gap insurance can be beneficial in several situations. For example, if you have a new car and you owe more on your loan than the car is worth, gap insurance can help cover the difference if your car is totaled or stolen.

Gap insurance can also be beneficial if you have a car that is older and has depreciated in value, but you still owe a significant amount on your loan.

Gap insurance covers the difference between the actual cash value of your car and the amount you owe on your loan. This can be a valuable protection if your car is totaled or stolen. Before you purchase gap insurance, it’s important to compare car insurance quotes to make sure you’re getting the best deal.

You should also consider your budget and the likelihood that you’ll need gap insurance.

How Gap Insurance Works

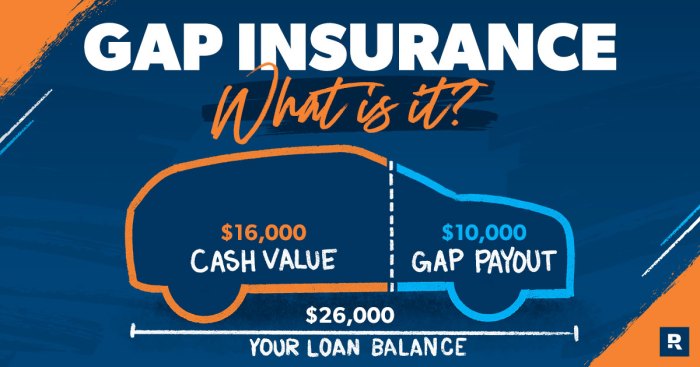

Gap insurance covers the difference between the actual cash value of a vehicle and the amount owed on the loan. This can be important if your vehicle is totaled or stolen, as the actual cash value may be less than what you owe on the loan.

Gap insurance is a coverage that fills the gap between the actual cash value of your car and the amount you owe on your loan or lease. This can be helpful if your car is totaled or stolen, as you may not receive enough from your insurance company to pay off your loan.

If you’re considering switching car insurance companies, it’s important to compare quotes from different providers to make sure you’re getting the best coverage for the best price. You can also learn more about gap insurance by visiting this website .

Gap insurance is typically sold as an add-on to your auto insurance policy. The cost of gap insurance varies depending on the value of your vehicle and the length of your loan.

How Gap Insurance Works in Different Scenarios

- If your vehicle is totaled or stolen and you owe more on the loan than the actual cash value of the vehicle, gap insurance will pay the difference.

- If your vehicle is repaired and the cost of repairs exceeds the actual cash value of the vehicle, gap insurance will pay the difference up to the amount of your loan.

- If you have a lease and your vehicle is totaled or stolen, gap insurance will pay the difference between the actual cash value of the vehicle and the amount you owe on the lease.

Benefits and Drawbacks of Gap Insurance

Gap insurance is an optional add-on coverage that can provide financial protection in the event of a total loss or theft of your vehicle. While it can offer peace of mind, it’s important to weigh the benefits and drawbacks before purchasing gap insurance.

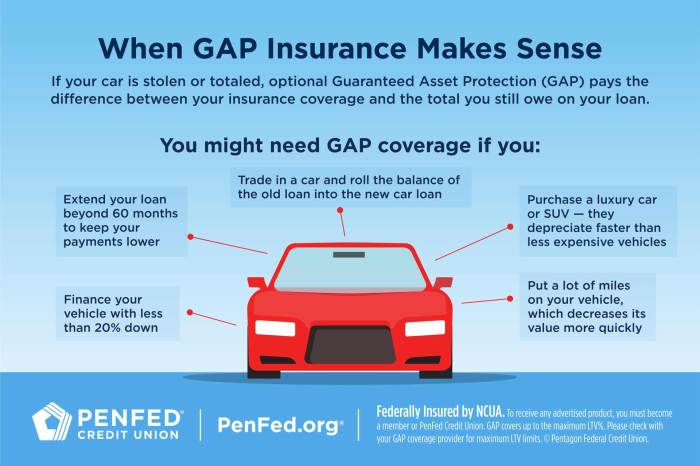

One of the main benefits of gap insurance is that it can help you avoid significant financial losses in the event of a total loss or theft of your vehicle. This is especially important if you have a newer vehicle with a high loan-to-value ratio, meaning you owe more on the loan than the car is worth.

Gap insurance covers the difference between the actual cash value of your car and the amount you owe on your loan or lease. If your car is totaled or stolen, gap insurance can help you pay off the remaining balance on your loan or lease.

Liability car insurance , on the other hand, protects you from financial responsibility if you cause an accident that injures someone or damages their property. While gap insurance is not required by law, it can be a valuable investment if you have a loan or lease on your car.

Without gap insurance, you would be responsible for paying the difference between the actual cash value of the vehicle and the amount you still owe on the loan.

For example, let’s say you have a new car that you financed for $30,000. After a year, the car is worth $25,000, but you still owe $28,000 on the loan. If your car is totaled in an accident, your insurance company will only pay you $25,000, leaving you responsible for the remaining $3,000. However, if you have gap insurance, the gap insurance would cover the $3,000 difference, so you wouldn’t have to pay anything out of pocket.

Gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your loan or lease. If your car is totaled in an accident, collision car insurance will pay to replace it, but only up to the actual cash value.

Collision car insurance does not cover the gap between the actual cash value and the amount you still owe, which is where gap insurance comes in.

Drawbacks of Gap Insurance, What is gap insurance

One of the main drawbacks of gap insurance is that it can be expensive. The cost of gap insurance varies depending on the value of your vehicle and the length of your loan, but it can typically cost several hundred dollars per year.

Another drawback of gap insurance is that it may not be necessary if you have a low loan-to-value ratio. If you have a down payment of 20% or more, or if you have been making extra payments on your loan, you may not need gap insurance.

This is because you will likely have enough equity in your vehicle to cover the difference between the actual cash value and the amount you owe on the loan.

Considerations for Purchasing Gap Insurance

When considering purchasing gap insurance, it’s crucial to evaluate various factors that influence its necessity. These factors include the vehicle’s value, loan terms, and personal financial situation.

Vehicle Value

The value of the vehicle is a primary consideration. Gap insurance is most beneficial for vehicles that depreciate rapidly or have a high loan-to-value ratio (LVR). If the vehicle’s value drops significantly below the loan balance, gap insurance can cover the difference.

Loan Terms

The length of the loan term also impacts the need for gap insurance. Longer loan terms result in more depreciation, increasing the likelihood of a negative equity situation. Gap insurance can provide peace of mind in such scenarios.

Personal Financial Situation

Your financial situation should also be taken into account. If you have a large emergency fund or other assets that can cover the potential gap, gap insurance may not be necessary. However, if your financial resources are limited, gap insurance can provide a safety net.

How to Determine if Gap Insurance is Right for You

To determine if gap insurance is right for you, consider the following:

- Estimate the vehicle’s depreciation rate and compare it to the loan repayment rate.

- Calculate the LVR and determine if it’s high.

- Assess your financial situation and consider whether you can afford the potential gap.

If the vehicle has a high depreciation rate, a long loan term, or your financial situation is uncertain, gap insurance can provide valuable protection against potential financial losses.

Wrap-Up: What Is Gap Insurance

Ultimately, the decision of whether or not to purchase gap insurance depends on your individual circumstances. If you’re concerned about being left with a financial burden in the event of a total loss, gap insurance can provide peace of mind and protect your financial well-being.

FAQ Insights

Is gap insurance required?

No, gap insurance is not required by law. However, it is highly recommended if you have a new vehicle or a loan with a high loan-to-value ratio.

How much does gap insurance cost?

The cost of gap insurance varies depending on the value of your vehicle and the terms of your loan. Typically, it costs between $200 and $500.

Is gap insurance worth it?

Whether or not gap insurance is worth it depends on your individual circumstances. If you’re concerned about being left with a financial burden in the event of a total loss, gap insurance can provide peace of mind and protect your financial well-being.