What is salvage value? This article delves into the concept, exploring its significance in financial analysis and providing practical insights into its calculation and applications in business decision-making.

Understanding salvage value empowers businesses to make informed choices, optimize asset management, and maximize financial performance.

Definition and Overview

Salvage value refers to the estimated value of an asset at the end of its useful life, when it is no longer in use by the owner but still has some remaining value. It represents the residual worth of the asset after depreciation and obsolescence have been taken into account.

Salvage value is a crucial factor in financial analysis, as it helps businesses and investors determine the overall cost of owning and operating an asset. By considering the salvage value, companies can make informed decisions about the acquisition, depreciation, and disposal of their assets.

Significance of Salvage Value

Salvage value plays a significant role in financial analysis for several reasons:

- Depreciation Calculation:Salvage value is used to calculate depreciation expenses, which are deducted from an asset’s cost over its useful life. It affects the timing and amount of depreciation charges, impacting the company’s income statement.

- Investment Decisions:Salvage value influences investment decisions by providing insights into the potential return on investment. Investors consider the salvage value when evaluating the profitability of an asset and making decisions about acquisition or disposal.

- Asset Disposal Planning:Salvage value guides companies in planning for the disposal of assets. By estimating the residual value, businesses can determine the most cost-effective disposal method, such as selling, scrapping, or recycling.

Examples of Salvage Value

Salvage value varies depending on the type of asset and industry. Here are some common examples:

- Vehicles:Cars, trucks, and other vehicles typically have a salvage value that reflects the value of their parts, scrap metal, or potential resale value.

- Machinery and Equipment:Industrial machinery and equipment often have a higher salvage value due to their specialized nature and potential resale to other businesses.

- Buildings:The salvage value of buildings can vary depending on their location, condition, and potential for redevelopment or repurposing.

- Intangible Assets:Some intangible assets, such as patents and trademarks, may have a salvage value if they can be sold or licensed to other parties.

Calculation Methods

Salvage value calculation methods vary depending on the industry, asset type, and availability of data. The most common methods include:

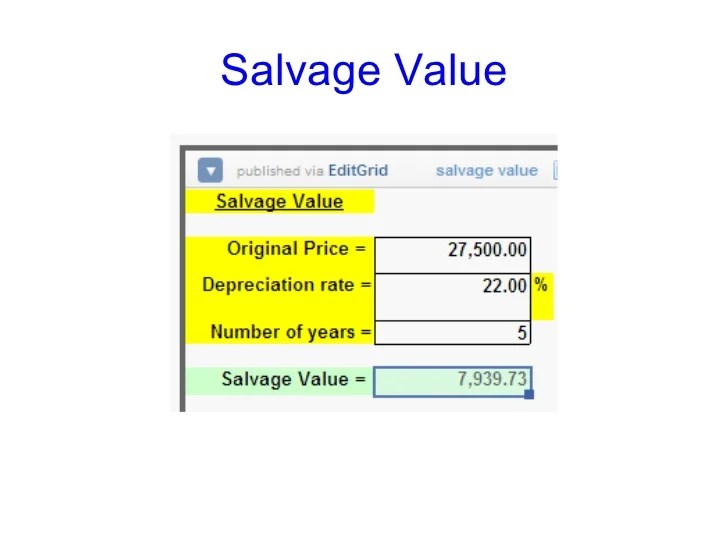

Depreciation Method

This method assumes a constant decline in the asset’s value over its useful life. The salvage value is estimated as a percentage of the asset’s original cost, typically ranging from 10% to 30%.

Market Value Method

This method involves obtaining an appraisal or researching comparable assets in the market to determine the current market value of the asset at the end of its useful life.

Income Approach Method

This method estimates the salvage value based on the potential income that the asset can generate after its useful life, such as through resale or scrap value.

| Method | Advantages | Disadvantages |

|---|---|---|

| Depreciation Method | Simple and easy to apply | May not reflect actual market value |

| Market Value Method | Accurate if market data is available | Can be time-consuming and expensive |

| Income Approach Method | Considers potential future income | Relies on assumptions about future income |

Factors influencing salvage value determination include the asset’s condition, age, obsolescence, market demand, and potential for resale or reuse.

Factors Affecting Salvage Value: What Is Salvage Value

Salvage value is influenced by a myriad of factors that vary across different asset types. Understanding these factors is crucial for businesses seeking to maximize the residual value of their assets.

Asset Type

The type of asset significantly impacts its salvage value. Equipment with specialized functions or limited applications tends to have lower salvage values than general-purpose assets with wider markets. For instance, a specialized manufacturing machine may have a lower salvage value than a standard office desk.

Salvage value is the estimated value of your car after it has been declared a total loss. If you’re planning on switching car insurance companies, it’s important to understand how salvage value can affect your claim. For more information on how to switch car insurance companies, click here . Once you’ve switched insurance companies, you can rest assured that your salvage value will be taken into account in the event of a total loss.

Condition and Age

The condition and age of an asset play a vital role in determining its salvage value. Assets that are well-maintained and regularly serviced tend to have higher salvage values than those in poor condition. Additionally, older assets typically have lower salvage values due to depreciation and technological advancements.

Market Demand

The market demand for an asset also affects its salvage value. Assets with high demand in the secondary market, such as vehicles or electronics, generally have higher salvage values. On the other hand, assets with limited demand may have negligible or even negative salvage values.

Technological Advancements

Rapid technological advancements can significantly impact the salvage value of certain assets. Assets that become obsolete due to new technologies may experience a sharp decline in their salvage values. For example, the advent of smartphones has drastically reduced the salvage value of traditional landline telephones.

Understanding salvage value, the estimated worth of your damaged vehicle after an accident, is crucial when filing a car insurance claim. Refer to our comprehensive guide How to file a car insurance claim for step-by-step instructions. This knowledge empowers you to navigate the claims process effectively and ensures you receive fair compensation for your salvage value.

Strategies to Enhance Salvage Value

To maximize the salvage value of assets, businesses can implement various strategies:

Regular Maintenance and RepairsProper maintenance and repairs extend the lifespan of assets and improve their condition, leading to higher salvage values.

Salvage value, a crucial aspect in determining the payout for damaged vehicles, is often influenced by factors such as the car’s age, condition, and market demand. Understanding salvage value is essential for car owners, as it can impact the amount they receive from their insurance company in the event of a total loss.

To learn more about the intricacies of car insurance policies, including the role of salvage value, visit What is a car insurance policy . This comprehensive guide provides valuable insights into the various aspects of car insurance, empowering you to make informed decisions about your coverage.

Obsolescence ManagementBusinesses should proactively monitor technological advancements and plan for the replacement of obsolete assets to minimize the impact on salvage values.

The salvage value of a car is what is left after it has been wrecked or totaled. This amount can vary depending on the age, make, model, and condition of the car. Collision car insurance can help to cover the cost of repairing or replacing your car if it is involved in an accident, and it can also help to cover the salvage value of the car if it is totaled.

When calculating the salvage value of a car, insurance companies will typically consider the following factors: the age of the car, the make and model of the car, the condition of the car, and the current market value of the car.

Asset Disposal PlanningDeveloping a comprehensive asset disposal plan helps businesses identify and dispose of assets at the optimal time to maximize their salvage value.

Remarketing and ResaleExploring remarketing or resale channels can help businesses recover additional value from used assets.

Applications in Business

Salvage value plays a crucial role in various aspects of business operations, including asset valuation, depreciation calculations, budgeting, financial planning, and investment decisions.

Asset Valuation and Depreciation

Salvage value is a key component in determining the carrying value of an asset. It is used to calculate depreciation expenses, which are recorded over the asset’s useful life to reflect the gradual decline in its value. By subtracting the salvage value from the asset’s initial cost, businesses can determine the depreciable basis, which is the amount that can be depreciated over the asset’s useful life.

Budgeting and Financial Planning, What is salvage value

Salvage value is considered when budgeting for future asset replacements. By estimating the salvage value of an asset at the end of its useful life, businesses can plan for the potential cash flow generated from its sale or disposal. This information helps businesses make informed decisions about capital expenditures and manage their cash flow more effectively.

Investment Decisions

Salvage value is a factor that investors consider when evaluating potential investments in fixed assets. A higher salvage value can increase the attractiveness of an investment by reducing the overall cost of ownership. Investors may use salvage value to calculate the payback period or return on investment (ROI) for a given asset.

Final Summary

In conclusion, salvage value plays a crucial role in asset valuation, depreciation, budgeting, and investment decisions. By considering the factors that influence salvage value and implementing strategies to enhance it, businesses can optimize their financial outcomes and make well-informed choices.

FAQs

What is the purpose of calculating salvage value?

Salvage value helps businesses estimate the residual value of an asset at the end of its useful life, enabling them to make informed decisions about asset disposal, depreciation, and replacement.

How does salvage value impact investment decisions?

Salvage value can influence investment decisions by providing insights into the potential return on investment. A higher salvage value can increase the attractiveness of an investment, as it reduces the overall cost of ownership.

What are some strategies to enhance salvage value?

Businesses can enhance salvage value by maintaining assets properly, keeping them in good condition, and upgrading or refurbishing them to extend their useful life.