In today’s competitive business landscape, safeguarding your assets is paramount. Commercial auto insurance plays a crucial role in protecting your company’s vehicles and ensuring financial stability in the event of an accident. This comprehensive guide will delve into the intricacies of commercial auto insurance, providing you with the knowledge and insights necessary to make informed decisions and secure the best coverage for your business.

As you navigate this guide, you will gain valuable insights into the factors that influence premiums, the intricacies of different coverage options, and the claims handling processes of leading insurance providers. Additionally, we will explore emerging industry trends and innovative solutions that are transforming the commercial auto insurance landscape.

Company Rankings and Reviews

Choosing the right commercial auto insurance provider is crucial for protecting your business. To help you make an informed decision, here’s a comprehensive ranking of the top companies based on customer satisfaction, financial stability, and coverage options.

Company Rankings

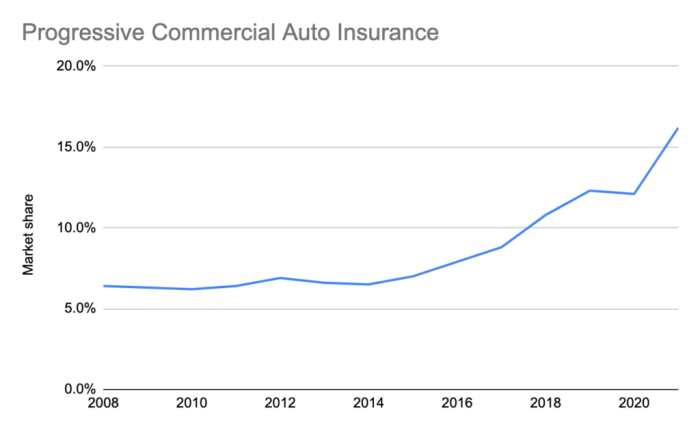

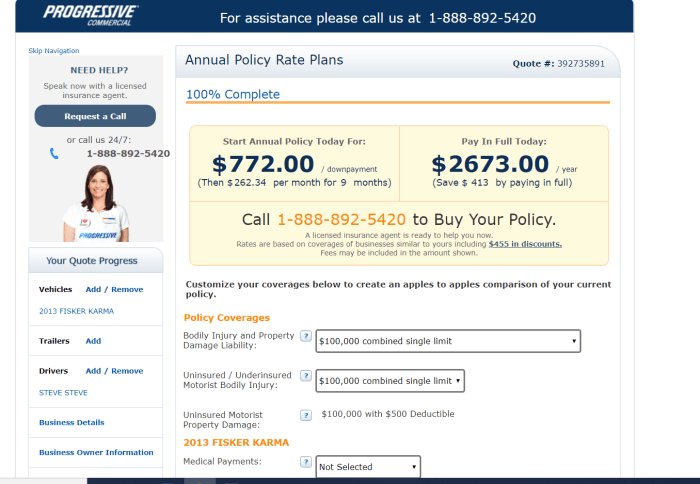

- Progressive: Known for competitive rates, flexible coverage options, and excellent customer service.

- State Farm: A reliable insurer with a strong financial foundation and a wide range of coverage options.

- Geico: Offers affordable rates and convenient online quoting and claims processing.

- Allstate: Provides comprehensive coverage options and has a reputation for prompt claims handling.

- Liberty Mutual: Known for its tailored coverage options and discounts for businesses with good safety records.

Company Reviews

Progressive

Strengths:

- Competitive rates

- Flexible coverage options

- Excellent customer service

Weaknesses:

- Higher deductibles on some policies

- Limited coverage options for certain industries

State Farm

Strengths:

- Strong financial foundation

- Wide range of coverage options

- Good customer satisfaction ratings

Weaknesses:

- Higher premiums than some competitors

- Not available in all states

Coverage Comparison

Commercial auto insurance policies provide a range of coverage options to meet the unique needs of businesses. Understanding the different types of coverage available and how they impact premiums and protection is essential.Essential coverages include:

- Liability Insurance: Covers damages caused to others, including bodily injury and property damage.

- Collision Insurance: Covers damage to your own vehicle in the event of a collision.

- Comprehensive Insurance: Covers damage to your vehicle caused by non-collision events, such as theft, vandalism, or weather.

Optional coverages include:

- Business Interruption Insurance: Covers lost income and expenses if your business is unable to operate due to a covered loss.

- Hired Auto Insurance: Covers vehicles that are rented or leased by your business.

The coverage options you choose will depend on the size and nature of your business, as well as your financial situation. It’s important to work with an insurance agent to determine the best coverage for your needs.

Factors Influencing Premiums

The cost of commercial auto insurance premiums varies depending on several factors that insurers consider when assessing the risk associated with insuring a business’s vehicles. Understanding these factors can help businesses make informed decisions to potentially lower their premiums without compromising coverage.

Business Type

The type of business a company operates can influence premiums. Businesses that engage in high-risk activities, such as transporting hazardous materials or operating heavy machinery, may face higher premiums due to the increased likelihood of accidents and claims.

Vehicle Usage

The frequency and purpose of vehicle use can also impact premiums. Businesses that use their vehicles for long distances or in congested areas may pay more than those that operate their vehicles primarily for local deliveries or errands.

Driving History

The driving records of employees who operate commercial vehicles are crucial in determining premiums. Businesses with drivers who have a history of accidents or traffic violations may face higher premiums due to the increased risk of future incidents.

Location

The location of a business can also affect premiums. Businesses located in areas with high rates of accidents or theft may face higher premiums than those in safer areas. Additionally, states have different insurance regulations and premium rates, which can impact the cost of coverage.

Tips for Reducing Premiums

- Maintain a good driving record for all drivers.

- Choose vehicles with safety features.

- Limit the number of drivers on the policy.

- Increase the deductible on the policy.

- Shop around for the best rates from multiple insurers.

Process and Customer Service

Evaluating the claims handling process of commercial auto insurance providers is crucial. Consider factors like:

- Ease of filing claims: Online portals, mobile apps, or 24/7 availability.

- Claim settlement timelines: Average time taken to process and approve claims.

- Customer support: Responsiveness, empathy, and resolution efficiency.

For example, Company A offers a user-friendly online claim filing system and boasts an average claim settlement time of 7 business days. Customer reviews praise their attentive and supportive staff.

Areas for improvement could include:

- Streamlining the claims process for faster resolutions.

- Providing personalized support tailored to specific business needs.

- Enhancing communication channels for real-time updates on claim status.

Industry Trends and Innovations

The commercial auto insurance industry is constantly evolving, with emerging trends and innovations shaping the landscape. These advancements aim to enhance coverage, reduce costs, and streamline processes for businesses.

Innovative Products and Technologies

* Telematics devices monitor vehicle usage, providing insurers with data on driving habits and risk profiles. This enables personalized premiums and incentives for safe driving.

- Usage-based insurance (UBI) programs charge premiums based on actual mileage and driving behavior, offering cost savings for businesses with low-mileage fleets.

- Artificial intelligence (AI) and machine learning algorithms analyze claims data to identify patterns and predict risks, improving underwriting accuracy and fraud detection.

Future of Commercial Auto Insurance

* Autonomous vehicles: As self-driving cars become more prevalent, insurance policies will need to adapt to address liability and coverage issues.

Shared mobility

Ride-sharing and carpooling services present unique insurance challenges, requiring policies that cover multiple drivers and varying levels of usage.

Electrification

The increasing adoption of electric vehicles is influencing insurance premiums, as electric vehicles have different risk profiles compared to gasoline-powered vehicles.These trends and innovations are transforming the commercial auto insurance industry, leading to more tailored coverage, reduced costs, and improved risk management for businesses.

Summary

Securing the best commercial auto insurance for your business is not merely a financial decision; it is an investment in your company’s well-being. By understanding the nuances of this insurance product, you can tailor a policy that meets your specific needs and protects your assets against unforeseen circumstances.

Remember, the best commercial auto insurance policy is the one that provides comprehensive coverage, competitive premiums, and exceptional customer service. With the knowledge gained from this guide, you can confidently navigate the insurance market and secure the optimal protection for your business.

Questions and Answers

What is the most important factor that influences commercial auto insurance premiums?

The most significant factor influencing commercial auto insurance premiums is the business’s driving history. A history of accidents and traffic violations can lead to higher premiums, while a clean driving record can result in lower premiums.

What are the different types of coverage typically included in a commercial auto insurance policy?

Commercial auto insurance policies typically include liability coverage, collision coverage, and comprehensive coverage. Liability coverage protects against financial responsibility for injuries or property damage caused to others in an accident. Collision coverage pays for repairs or replacement of the insured vehicle if it is damaged in a collision with another vehicle or object.

Comprehensive coverage provides protection against non-collision related damages, such as theft, vandalism, or weather-related events.

What is the best way to reduce commercial auto insurance premiums?

There are several ways to reduce commercial auto insurance premiums. Maintaining a clean driving record, increasing deductibles, taking defensive driving courses, and installing safety devices in vehicles can all help to lower premiums.