How much does car insurance cost? It’s a question that weighs heavily on the minds of drivers everywhere. In this in-depth exploration, we delve into the complexities of car insurance pricing, revealing the myriad factors that shape its enigmatic nature.

Brace yourself for a journey that unravels the mysteries surrounding this essential expense.

From demographics and driving history to regional variations and company discounts, we leave no stone unturned in our quest for clarity. Whether you’re a seasoned driver or a novice behind the wheel, this guide empowers you with the knowledge to make informed decisions and navigate the world of car insurance with confidence.

Factors Influencing Car Insurance Costs

Car insurance costs are not fixed and can vary significantly from one driver to another. Several factors influence the premiums insurance companies charge, and understanding these factors can help you make informed decisions to potentially lower your insurance costs.

The following table provides a comprehensive list of factors that affect car insurance premiums:

| Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers are generally considered higher risk and pay higher premiums. |

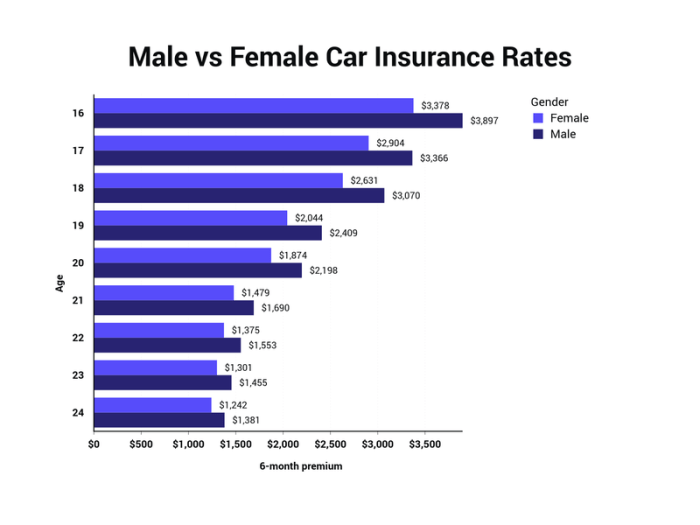

| Gender | In some cases, gender can affect insurance rates, with male drivers paying slightly higher premiums than female drivers. |

| Driving History | A clean driving record with no accidents or traffic violations can lead to lower premiums. |

| Vehicle Type | The make, model, and safety features of your car can influence insurance costs. |

| Coverage Level | Higher coverage levels, such as comprehensive and collision coverage, result in higher premiums. |

| Location | Insurance rates vary based on the geographic location where you live, with urban areas typically having higher rates. |

| Credit Score | In some states, insurance companies use credit scores to determine insurance rates, with higher credit scores leading to lower premiums. |

| Annual Mileage | Drivers who drive fewer miles per year may qualify for lower insurance rates. |

| Usage | If you use your car for business or commercial purposes, your insurance rates may be higher. |

| Discounts | Insurance companies offer various discounts, such as multi-car discounts, good student discounts, and safe driver discounts, which can reduce premiums. |

Average Car Insurance Costs

Car insurance costs vary significantly depending on various factors, including region, demographics, and driving history. Here’s an overview of average costs and the reasons behind their variations.

How much does car insurance cost? It’s a question that many drivers ask themselves. The answer can vary depending on a number of factors, including your age, driving record, and the type of car you drive. If you’re looking for more information on how to manage your finances, consider checking out Optum Financial: A Comprehensive Guide to Your Financial Well-being . This guide can help you understand the basics of personal finance and make informed decisions about your money.

When it comes to car insurance, there are a few things you can do to save money. You can shop around for the best rates, increase your deductible, or take a defensive driving course. By following these tips, you can help keep your car insurance costs down.

Regional Variations

Car insurance costs differ across regions due to factors such as population density, crime rates, and the cost of living. For instance, urban areas typically have higher insurance premiums than rural areas because of increased traffic congestion, accident risks, and higher repair costs.

Demographic Variations

Demographics also play a role in determining insurance costs. Here’s a breakdown of average costs based on key demographics:

| Demographic | Average Cost |

|---|---|

| Age | Younger drivers (under 25) pay higher premiums due to their higher risk of accidents. Premiums gradually decrease with age and experience. |

| Gender | Statistically, male drivers pay slightly higher premiums than female drivers due to higher accident rates. |

| Driving History | Drivers with clean driving records and no accidents or violations typically qualify for lower premiums. Conversely, drivers with poor driving histories face higher costs. |

Comparing Car Insurance Quotes

Comparing car insurance quotes from multiple providers is essential to secure the best coverage at an affordable price. By evaluating different quotes, you can determine which insurer offers the most comprehensive protection, personalized options, and competitive rates that align with your needs and budget.

paragraph

The cost of car insurance varies widely depending on factors such as your driving history, age, and location. However, financing your vehicle through TD Auto Finance: Unlocking Financial Freedom for Vehicle Ownership can help you secure a competitive interest rate and save money on your monthly payments.

This can free up cash flow that can be used to cover the cost of car insurance and other expenses.

Tips for Effectively Comparing Quotes

- Gather relevant information:Determine your coverage needs, vehicle details, driving history, and any additional factors that may influence your premium.

- Obtain quotes from various providers:Contact multiple insurance companies, including national carriers, regional insurers, and independent agents, to get a wide range of options.

- Review coverage details thoroughly:Compare the coverage limits, deductibles, and policy terms of each quote to ensure you understand the extent of protection provided.

- Consider premium costs and discounts:Analyze the total annual or monthly premiums and any applicable discounts or credits offered by each provider.

- Read reviews and testimonials:Seek feedback from other policyholders to gain insights into the customer service, claims handling, and overall experience with different insurers.

Organizing and Evaluating Quotes, How much does car insurance cost

To facilitate an effective comparison, organize the quotes in a table or spreadsheet. Include the following key information:

| Provider | Coverage Details | Premium | Discounts | Customer Reviews |

|---|---|---|---|---|

| Company A | Liability: 100/300/50 | Collision: $500 deductible | Comprehensive: $500 deductible | $1,200 | Multi-car, safe driver | 4.5 stars |

| Company B | Liability: 150/500/100 | Collision: $250 deductible | Comprehensive: $250 deductible | $1,500 | Good student, low mileage | 4.2 stars |

| Company C | Liability: 200/500/100 | Collision: $1,000 deductible | Comprehensive: $1,000 deductible | $1,000 | Loyalty, accident-free | 4.8 stars |

By carefully comparing the quotes, you can identify the provider that offers the most suitable coverage, competitive rates, and reliable service, ensuring you make an informed decision that meets your specific car insurance needs.

Ways to Save on Car Insurance

Many strategies can help you reduce your car insurance premiums. Insurance companies offer various discounts and programs to reward safe driving and loyalty. By taking advantage of these opportunities and implementing some practical tips, you can save a significant amount of money on your car insurance.

Car insurance costs can vary widely depending on several factors. To get a better understanding of how much you might pay, it’s a good idea to do some research on insurance companies and compare quotes. This can help you find the best coverage at a price that fits your budget.

Keep in mind that car insurance costs can fluctuate over time, so it’s important to review your policy regularly to ensure you’re still getting the best deal.

Discounts and Programs

*

The cost of car insurance can vary widely depending on a number of factors. If you’re looking for a reliable and affordable option, consider Mahindra Finance . They offer competitive rates and a range of coverage options to suit your needs.

When it comes to car insurance, it’s important to compare quotes from multiple providers to find the best deal.

-*Safe Driver Discounts

Many insurers offer discounts for drivers with clean driving records, such as accident-free and ticket-free driving for a certain period.

Car insurance costs can vary widely depending on factors such as your driving history, age, and location. If you’re looking to finance your dream car, it’s important to factor in the cost of insurance. CarMax Finance offers a range of financing options to help you get behind the wheel of your dream car.

With competitive rates and flexible terms, CarMax Finance can help you find a financing solution that fits your budget. So, when you’re considering the cost of car insurance, be sure to keep CarMax Finance in mind for all your financing needs.

-*Loyalty Discounts

Some companies reward customers who stay with them for multiple years with loyalty discounts.

-*Multi-Policy Discounts

Insuring multiple vehicles or bundling your car insurance with other policies, such as homeowners or renters insurance, can qualify you for discounts.

-*Defensive Driving Courses

Completing approved defensive driving courses can demonstrate your commitment to safe driving and earn you discounts.

-*Good Student Discounts

Insurers may offer discounts to students who maintain good grades, recognizing their responsibility and lower risk of accidents.

Practical Tips for Saving Money

*

-*Increase Your Deductible

Raising your deductible, the amount you pay out of pocket before insurance coverage kicks in, can lower your premiums.

-*Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Get quotes from multiple insurers to find the best deal.

-*Consider Usage-Based Insurance

Some insurers offer programs that track your driving habits and reward you for safe driving with lower premiums.

-*Maintain a Good Credit Score

Insurers use your credit score to assess your financial responsibility and risk. A higher credit score can lead to lower premiums.

-*Avoid Lapses in Coverage

Maintaining continuous insurance coverage is essential. Lapses can result in higher premiums when you reinstate coverage.

Last Point

In the realm of car insurance, understanding the intricacies of pricing is paramount. By delving into the factors that influence premiums and exploring strategies to minimize costs, we’ve equipped you with the tools to make informed decisions. Remember, car insurance is not merely an expense; it’s an investment in your financial well-being and peace of mind.

Embrace this knowledge, compare quotes diligently, and drive with the assurance that you’re adequately protected without breaking the bank.

Essential FAQs: How Much Does Car Insurance Cost

What factors have the greatest impact on car insurance premiums?

Age, driving history, location, and type of vehicle are among the most significant factors.

Why do car insurance costs vary so much between different regions?

Factors such as population density, crime rates, and the frequency of accidents contribute to regional variations.

What are some effective ways to save money on car insurance?

Maintaining a clean driving record, bundling policies, and taking advantage of discounts offered by insurance companies can help reduce premiums.

1 comment

Comments are closed.