As What is a deductible on car insurance takes center stage, this opening passage beckons readers into a world crafted with knowledge, ensuring a reading experience that is both absorbing and distinctly original. Delve into the intricacies of deductibles, their role in shaping insurance premiums, and the impact they have on claims and coverage.

The subsequent paragraphs provide descriptive and clear information about the topic, elaborating on the different types of deductibles, their advantages and disadvantages, and how they affect the claims process. Guidance is offered on choosing the right deductible for individual needs, considering financial situations, risk tolerance, and frequency of claims.

Understanding the Deductible Concept

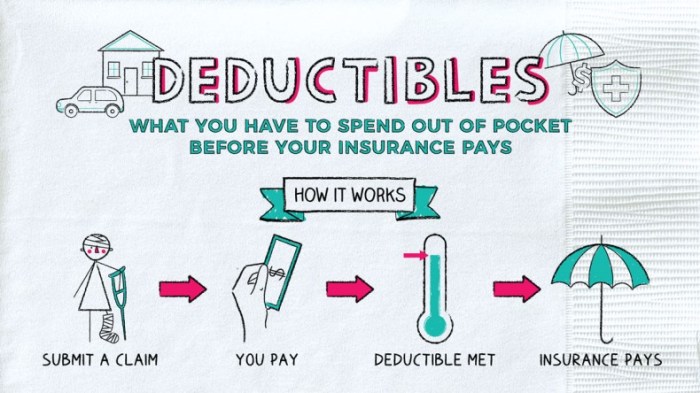

A deductible is a predetermined amount of money that you, as the policyholder, agree to pay out-of-pocket before your car insurance coverage kicks in. Deductibles play a crucial role in determining your insurance premiums and the extent of your coverage.

When you choose a higher deductible, you effectively reduce your insurance premiums. This is because the insurance company assumes less risk by having you cover a larger portion of the initial repair costs. Conversely, opting for a lower deductible means you’ll pay higher premiums but have less out-of-pocket expenses in the event of an accident.

A deductible on car insurance is the amount you pay out of pocket before your insurance coverage kicks in. Deductibles can vary depending on your policy, but they typically range from $250 to $1,000. If you have a comprehensive car insurance policy, you may also have a separate deductible for damage caused by things like theft or vandalism.

To learn more about comprehensive car insurance, click here . Ultimately, the deductible you choose will depend on your budget and your risk tolerance. If you’re comfortable paying a higher deductible, you’ll typically pay lower premiums. But if you’re more likely to file claims, you may want to choose a lower deductible.

Common Deductible Amounts and Their Impact, What is a deductible on car insurance

Common deductible amounts range from $0 to $1,000 or more. The impact of your deductible on coverage varies depending on the amount you choose. For instance, a $0 deductible means you won’t have to pay anything out-of-pocket for repairs, but your premiums will be higher.

On the other hand, a $1,000 deductible will require you to pay the first $1,000 of repair costs, but your premiums will be lower.

The deductible on car insurance is the amount you pay out of pocket before your insurance coverage kicks in. This amount can vary depending on your policy, so it’s important to understand how it works. If you’re looking to save money on car insurance, there are a few things you can do.

You can learn more about how to get cheap car insurance , or you can shop around for different quotes. By following these tips, you can get the coverage you need at a price you can afford. Additionally, you should also consider increasing your deductible.

This will lower your monthly premiums, but it will also mean that you will have to pay more out of pocket if you need to file a claim.

Types of Deductibles

Car insurance deductibles vary based on the type of coverage. Understanding the different types of deductibles can help you make informed decisions about your insurance policy.

Comprehensive Deductible

A comprehensive deductible applies to damages caused by non-collision events, such as theft, vandalism, or natural disasters. Comprehensive deductibles tend to be lower than collision deductibles.

Collision Deductible

A collision deductible applies to damages caused by a collision with another vehicle or object. Collision deductibles are typically higher than comprehensive deductibles.

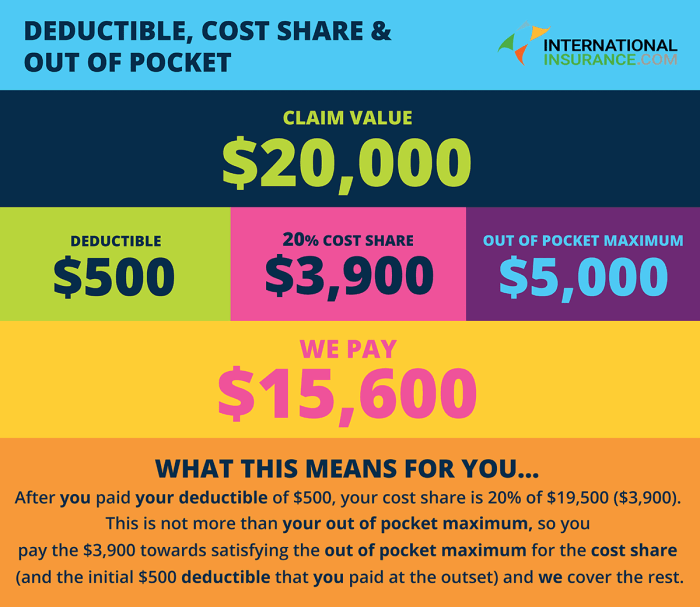

When choosing car insurance, understanding deductibles is essential. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For instance, if you have a $500 deductible and get into an accident that costs $2,000 to repair, you would pay the first $500, while your insurance would cover the remaining $1,500. This concept is crucial when considering collision car insurance , which covers damage to your vehicle in the event of a collision with another vehicle or object.

Understanding deductibles helps you make informed decisions about your car insurance policy and ensures you have the right coverage for your needs.

Combined Deductible

A combined deductible combines both comprehensive and collision deductibles into a single amount. This type of deductible can be advantageous for drivers who frequently file claims.

Impact of Deductibles on Claims

Deductibles significantly impact the claims process and the amount of money you receive from your insurance company. Understanding the terms of your deductible before filing a claim is crucial to avoid surprises or disputes.

When it comes to car insurance, understanding the nuances of coverage is crucial. A deductible, for instance, is the amount you pay out of pocket before insurance kicks in. This can significantly impact your financial responsibility in the event of an accident.

However, it’s equally important to consider uninsured motorist coverage , which protects you if you’re involved in an accident with an uninsured or underinsured driver. By balancing these factors, you can tailor your car insurance policy to meet your specific needs and provide comprehensive protection on the road.

Minimizing the Impact of Deductibles

- Choose a higher deductible:Opting for a higher deductible lowers your insurance premiums. However, ensure you can afford to pay the higher deductible if you need to file a claim.

- Consider your financial situation:If you have limited savings or struggle to pay unexpected expenses, a lower deductible may be more suitable to minimize the financial burden of a claim.

- Bundle insurance policies:Combining your auto and home insurance with the same company often qualifies you for discounts on both policies, potentially reducing your overall insurance costs.

- Maintain a good driving record:Safe driving practices can help you earn discounts on your insurance premiums, which can offset the impact of a higher deductible.

Deductible Options and Considerations: What Is A Deductible On Car Insurance

Selecting a deductible involves weighing financial factors against risk tolerance and claims frequency. Understanding the available options and their implications is crucial.

Deductible Options

Various deductible options exist, each with its advantages and drawbacks:

- Zero Deductible:No out-of-pocket expenses for repairs or replacements, but premiums are typically higher.

- High Deductible:Lower premiums but higher out-of-pocket costs in the event of a claim. Can be combined with higher coverage limits.

- Variable Deductible:Adjustable deductible based on factors like vehicle age or driving record. Allows for customization and potential premium savings.

Factors to Consider

When choosing a deductible, consider the following factors:

- Financial Situation:Higher deductibles reduce premiums but require more out-of-pocket expenses in case of a claim.

- Risk Tolerance:Determine the level of financial risk you’re comfortable with in the event of an accident or damage.

- Frequency of Claims:If you’re prone to accidents or repairs, a lower deductible may be more suitable.

Final Thoughts

In conclusion, understanding deductibles is crucial for making informed decisions about car insurance coverage. By carefully considering the factors discussed, individuals can optimize their insurance plans, ensuring adequate protection without overpaying for premiums. Remember, the deductible serves as a balancing act between affordability and coverage, and choosing wisely can lead to significant savings and peace of mind.

FAQ Overview

What is the purpose of a deductible in car insurance?

A deductible is a specific amount that the policyholder agrees to pay out of pocket before the insurance company covers the remaining costs of a claim. It serves as a risk-sharing mechanism, influencing insurance premiums and coverage.

What are the different types of deductibles available?

There are various types of deductibles, including comprehensive deductibles (for non-collision damage), collision deductibles (for collision damage), and combined deductibles (covering both comprehensive and collision claims). Each type has its advantages and disadvantages.

How do deductibles affect the claims process?

When filing a claim, the policyholder is responsible for paying the deductible amount before the insurance company covers the remaining costs. Understanding deductible terms is essential to avoid unexpected expenses and ensure a smooth claims process.